Cell C has switched off a third of its RAN network

South African operator Cell C has now decommissioned 34% of its physical radio access network (RAN) sites.

The cash-strapped operator is continuing with a strategy to move away from spending money on infrastructure and instead become a wholesale buyer of capacity and services. Cell C wants to get rid of its tower infrastructure within the next three years and permanently roam on other networks.

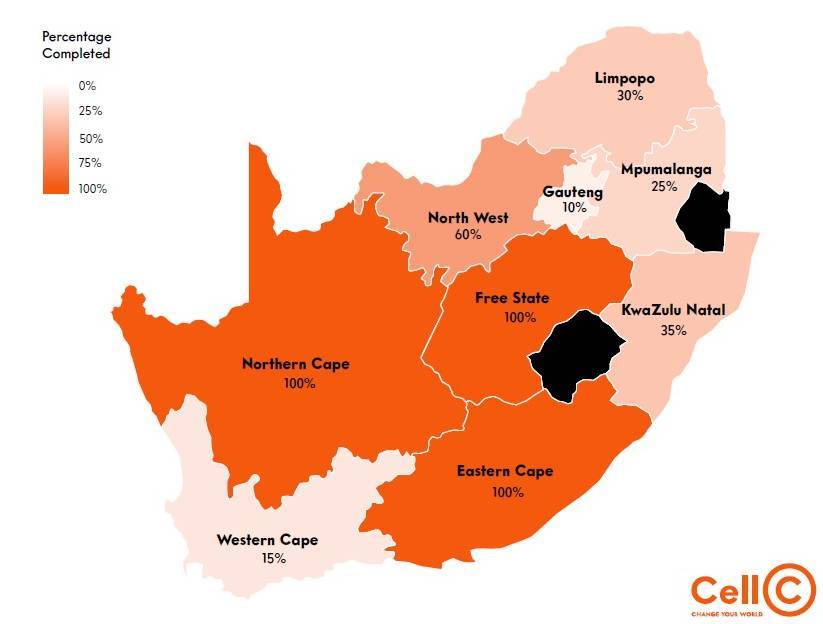

SA's fourth-biggest mobile network said in a statement that its first phase of the strategy was focused on three provinces – the Eastern Cape, Free State and Northern Cape – which are now 100% complete.

In the next six months, Cell C plans to decommission a further 10% of its network sites, with a focus in North-West, Limpopo, Western Cape, KwaZulu-Natal and Mpumalanga.

"Our network strategy is to strengthen our position as a wholesale buyer and aggregator of network capacity with a quality network and become a digital services provider," said Cell C's CTO Schalk Visser.

Through its expanded roaming agreement with MTN, Cell C will have access to more than 12,500 4G/LTE-ready sites for its prepaid and mobile virtual network operator (MVNO) customers across the country, with completion scheduled for late 2023.

The initial Cell C and MTN roaming agreement from 2018 provided coverage in areas outside of the main metros. The decommissioning of sites in these provinces means that where Cell C customers previously moved between Cell C and MTN towers, they will now only roam on MTN's network through the virtual radio network provisioned for Cell C, which has wide network coverage.

"If our strategy were to play catch up to the Vodacom and MTN networks, we would have to invest R1.5 billion (US$105 million) per year for 18 years – conservatively estimated at R27 billion ($1.9 billion) – based on the assumption that we would be able to build 400 new cellular sites per year, and assuming Vodacom and MTN did not build any new sites during this period. This investment in our network infrastructure would be impossible to maintain," explained Visser.

Cell C said that based on technology advances it is possible for network operators to avoid duplication of investment in RAN infrastructure. In this model, Cell C will decommission its physical RAN, which includes towers, basestations, antennae, radio and transmission equipment, while MTN will provision a virtual RAN.

Cell C will use its own spectrum on this virtual RAN and manage the customer experience. As a mobile network operator Cell C is still responsible for its spectrum licenses, core network, transport network, billing system and subscriber management.

This approach will significantly reduce network expenses and capital expenditure for the operator that reported a yearly loss of R5.5 billion (US$390 million) for the 2020 financial year.

Related posts:

- SA's Cell C reports $386M full-year loss

- SA's Cell C migrating customers to roam on competitor networks

- Cell C recapitalization making good progress

- Cell C Strikes Roaming Deal Across South Africa With MTN

— Paula Gilbert, Editor, Connecting Africa