SA's FNB adds ChatPay feature, overhauls banking app

South Africa's First National Bank (FNB) is branching further into the fintech space with the launch of new mobile-specific payment options that target the country's ever-evolving digital payment needs.

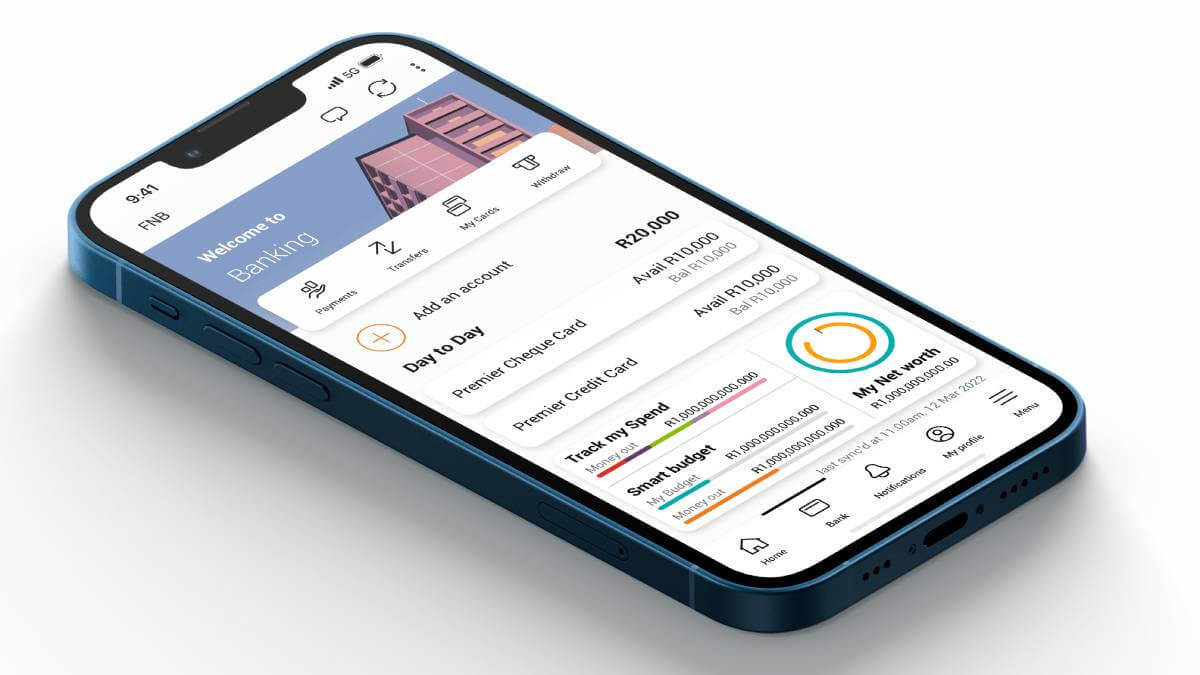

While launching a redesigned logo and an updated smartphone app last week, the bank introduced a number of innovative payment and money transfer solutions including ChatPay, which allows customers to pay or request payment from any FNB customer using the app's chat functionality without needing a bank account number.

The bank already had its own digital wallet, FNB Pay, which works similarly to Apple Pay or Google Wallet and allows users to pay for goods and services using their smartphone rather than a physical bank card.

FNB said that it now plans to make FNB Pay the "payments umbrella" for the whole banking app which will allow customers to split a bill via their cell phone and also lets business owners receive contactless payments on their Android smart devices, without the need for a separate point-of-sale device.

Earlier this year the bank revealed that monthly payments via FNB Pay digital wallets have surpassed 1 billion South African rand (US$55 million). It said that the use of FNB Pay-supported digital wallets has increased by more than 800% year-on-year in volumes.

Digital evolution

"We continue to facilitate our customers' journey from analogue to digital and digital to platform. We're excited to see millions of our customers embracing the migration to more accessible, user-friendly, and safer interfaces," said FNB CEO Jacques Celliers.

"Our digital interfaces have become a one-stop shop for customers' financial and lifestyle needs, with over 3 billion transactions and 1.6 billion digital interactions over the past 12 months," Celliers added.

As well as ChatPay, the company has integrated a number of other new features into the bank's app including:

"Customers can now personalize their FNB app by customizing its home screen and selecting frequently used or preferred features," FNB added in a statement.

FNB also introduced Money Protect, which it claimed was an "industry-first benefit" of free insurance cover for certain fraud-related losses when using its app or ATMs.Related posts:

- SA bank Capitec launches MVNO with data that never expires

- Voice still key for FNB Connect users

- SA becomes first African nation to get Google Wallet

*Top image shows FNB's newly designed smartphone app. (Source: FNB)

— Matshepo Sehloho, Associate Editor, Connecting Africa