Africa's fintech market to top US$65B by 2030

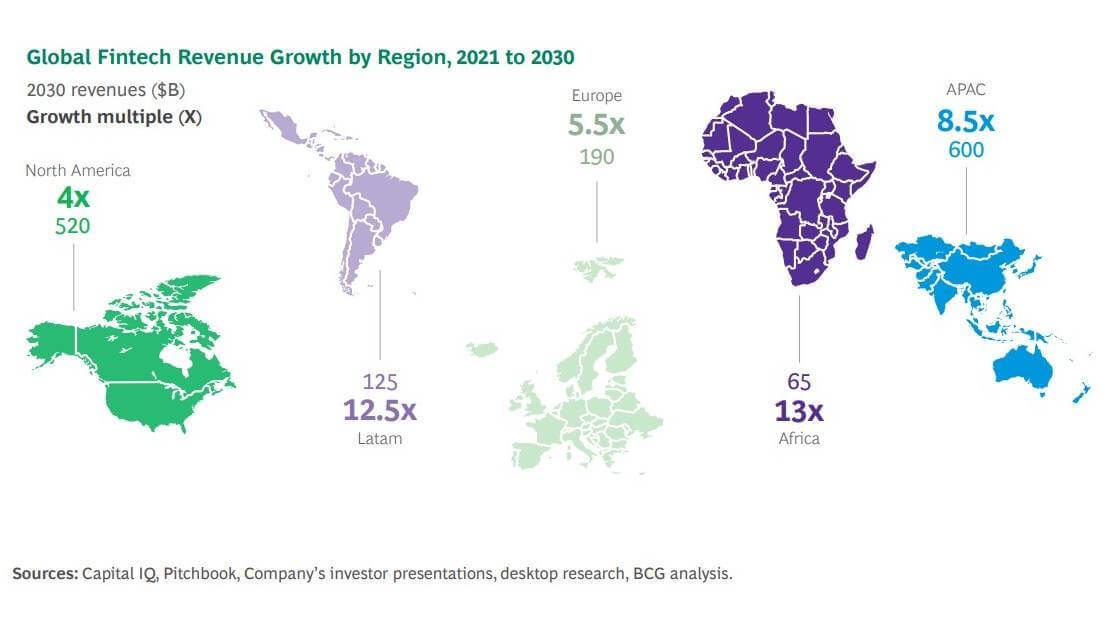

Africa is set to be the fastest growing region when it comes to fintech revenue, with a compound annual growth rate (CAGR) of 32% from now until 2030, according to a new report from Boston Consulting Group (BCG) and QED Investors.

The report, Global Fintech 2023: Reimagining the Future of Finance found that Africa's fintech market – led by South Africa, Nigeria, Egypt, and Kenya – is projected to grow thirteenfold to US$65 billion in 2030.

"Unencumbered by legacy infrastructure, Africa can leapfrog its way to a new financial ecosystem and address the challenges of a population that is predominantly unbanked or underbanked. Nearly 500 million adults in the Middle East and Africa (MEA) region are unbanked – that is 52% – while 43% are underbanked," said Caio Anteghini, partner at BCG, Johannesburg.

"Fintech could be a vehicle to solve the access issue, with smartphones presenting major opportunities in payments and lending for regional champions with full-stack attacker models," he added.

Globally financial technology revenues are projected to grow sixfold from $245 billion to $1.5 trillion by 2030.

Emerging economies are predicted to lead the way globally as fintech gains momentum. Asia-Pacific (APAC) is poised to outpace the US, becoming the world's largest fintech market by 2030, with a projected CAGR of 27%.

"Globally and in Africa, the fintech journey is still in its early stages and will continue to revolutionize the financial services industry as we know it," said Anteghini.

(Source: Global Fintech 2023: Reimagining the Future of Finance report).

"All stakeholders must therefore seize the moment. Regulators need to be proactive and lead from the front, while incumbents should partner with fintechs to accelerate their own digital journeys," he continued.

Despite global fintechs losing more than half their market value on average in 2022, the report found that the plunge was merely a short-term correction in an otherwise long-term positive trajectory, as the industry's fundamental growth drivers haven't changed.

"We expect to see continued growth not only in developed markets in the US and Europe, but also in developing fintech markets in Latin America, Asia, and Africa, where the inertia and friction is even greater. QED remains more bullish than ever about the future of fintech and its promise to improve the lives of billions of people across the world," added Nigel Morris, QED Investors managing partner and co-author of the report.

Africa's fintech future

"In Africa, although cash is still king, fintech could be a vehicle to solve the access issue, as most of the population is still either underserved by banks or fully unbanked. As the youngest and fastest-growing region globally – with a median age of roughly 19 and projected population growth of an additional 1.2 billion people by 2050 – demographic shifts and earning-power increases will deepen the need for financial access," the report said.

BCG and QED Investors expect some degree of leapfrogging in technology, particularly when it comes to cashless payments. In Nigeria, 73% of adults have a smartphone, but a mere 2% have credit cards.

"Most Africans' first interaction with the financial services sector may be through their smartphones – presenting major fintech opportunities in payments and lending for regional champions with full-stack attacker models," the authors said.

Historically, telco-fintech players, such as Safaricom's M-Pesa and MTN Mobile Money have led much of the segment's growth in the region. Such players are expected to maintain their major role, alongside grassroots fintechs.

The role of regulators

"Regulation of fintechs has traditionally been relatively light, non-proactive, fragmented, and, in some cases, even lagging behind," the authors said.

While recent bank crises have made them more sensitive to asset/liability management, in addition to creating guardrails, regulators must ensure they are not over regulating the industry and thereby stifling innovation.

The report suggests that regulators should consider leveling the playing field through enabling faster pathways for banking and payment institution licenses; facilitating an open banking ecosystem; and supporting digital public infrastructure.

"The rise of new technologies has created a need for next-gen infrastructure that can facilitate complex transactions in a more digital world – and systems that facilitate the delivery of essential services and benefits to the general public, such as digital ID and verification, can promote economic expansion, especially in emerging markets," added Anteghini.

In emerging markets, neo banks are also expected to play a key role in expanding financial access and inclusion.

The era of fintech growth

While payments led the first part of the fintech journey, and will remain the largest fintech segment in 2030 growing fivefold to $520 billion, the report's authors believe B2B2X (business-to-business-to-any-user) and B2b (serving small businesses) will lead the next era.

B2b fintech revenues are projected to grow at a 32% CAGR to become a $285 billion market by 2030. There are roughly 40 million small to mid-sized enterprises (SMEs) in Nigeria, and more than 400 million in total globally.

In Africa, SMEs provide over 80% of all jobs across the continent – showcasing the enormous opportunity for growth for fintechs in this space.

Meanwhile the B2B2X market is expected to grow at a 25% CAGR to reach $440 billion in annual revenues by 2030, supported by growth in embedded finance and financial infrastructure.

"We are in the early stages of a 25-year (or longer) growth journey, and the opportunities for growth, particularly in emerging markets like Africa, are only just gathering momentum," concluded Anteghini.

Related posts:

- Ericsson eyes mobile financial services growth in Africa

- Connecting Africa Podcast S2 Ep. 8 – Empowering the African diaspora

- Connecting Africa Podcast: S2 Ep. 3 – Building fintech in Ghana

*Top image source: Image by wayhomestudio on Freepik.

— Paula Gilbert, Editor, Connecting Africa