Ericsson: Sub-Saharan Africa will have 67% smartphone users by 2029

Sub-Saharan Africa is forecast to have 1.1 billion mobile subscriptions by 2029, and 760 million – or 67% of those – will be smartphone subscriptions.

That's according to the Ericsson Mobility Report for November 2023, which found that the telecom sector in sub-Saharan Africa remains resilient even though the region is facing funding challenges and high inflation.

"Connectivity has become a basic need for voice and data communications, as well as for enabling services such as banking, which have traditionally had low penetration," Ericsson said.

The region will have the highest overall subscription growth globally, with total mobile subscriptions projected to rise 3% year-over-year for the next six years, with a 9% increase in 4G subscriptions.

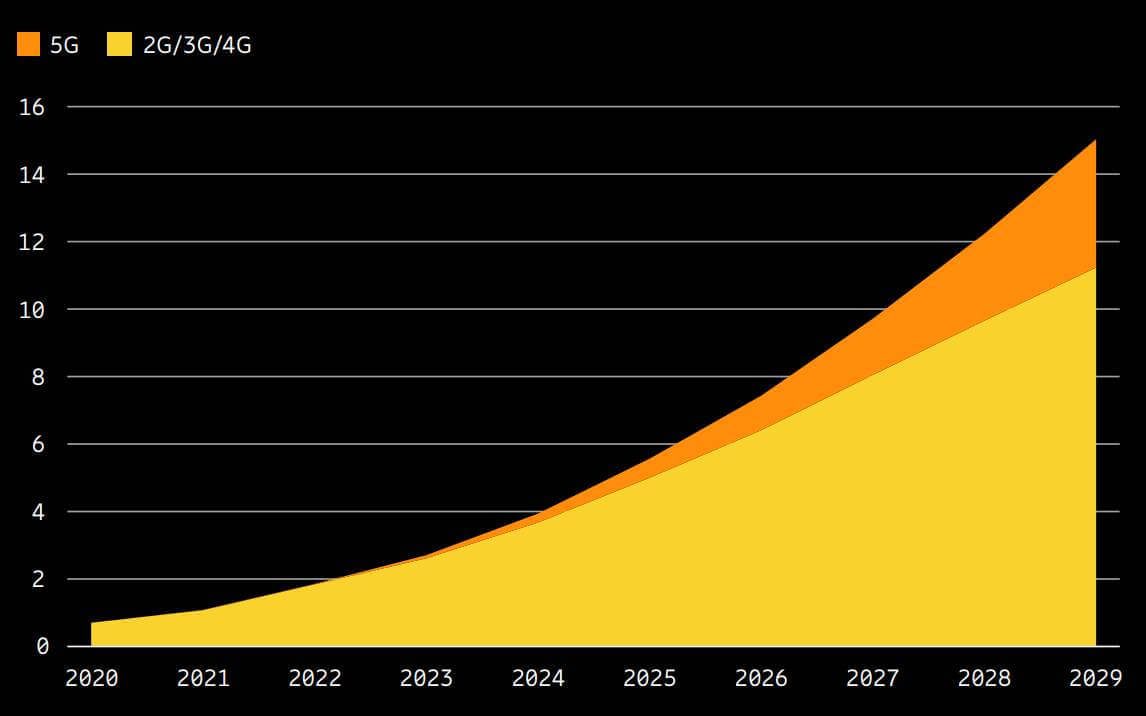

Sub-Saharan Africa is also poised to remain the region with the highest growth in total mobile data traffic, with a compound annual growth rate (CAGR) of 33% expected between 2023 and 2029.

The growing adoption of smartphones, especially affordable devices, is expected to lead to an annual increase of more than 20% in data consumption per smartphone throughout this period, from 6.7GB per month to 23GB per month.

4G forecast flows up

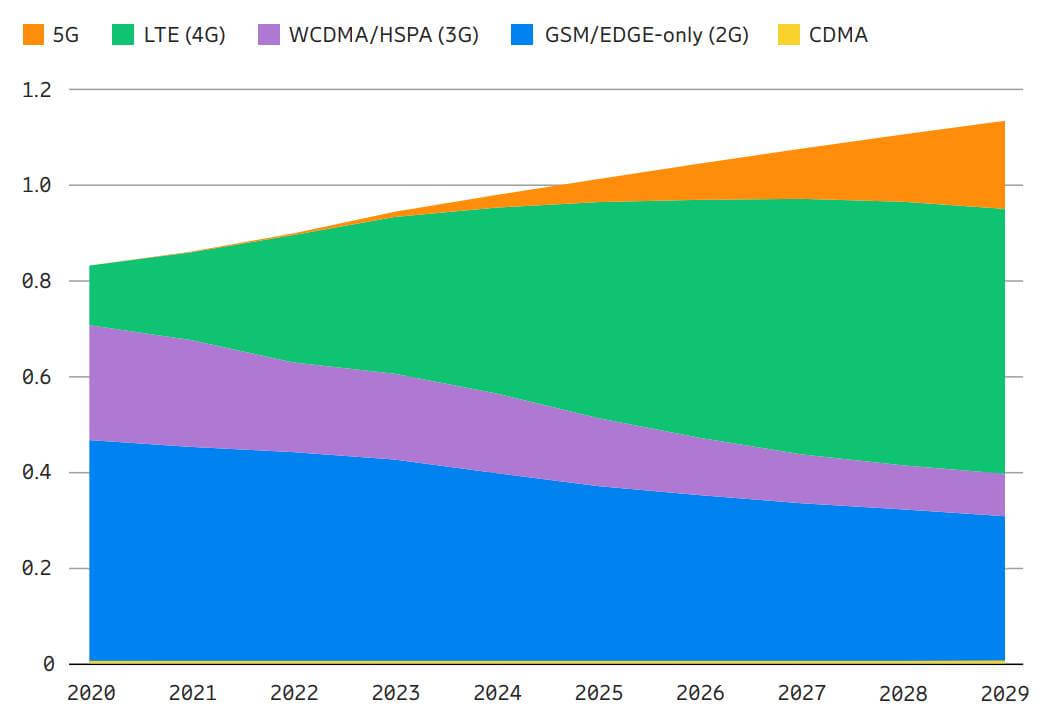

4G will be the primary driver for new mobile subscriptions over the next five years. By the end of 2029, 4G subscriptions are forecast to account for half of all mobile subscriptions in sub-Saharan Africa.

"In the pursuit of modernization and enhanced connectivity, subscribers are constantly migrating toward 4G networks," Ericsson said. "This technological shift underscores a pivotal moment in the region's telecom landscape."

The report's authors believe that 4G's prevalence is poised to redefine the way communities engage with digital services, be it for education, commerce, healthcare or social interactions.

Meanwhile, 3G will shrink from 19% of the total in 2023, to below 8% in 2029 as 4G grows.

"Service providers in Sub-Saharan Africa are evolving into technology companies, integrating mobile money services into their digital portfolios. This shift not only enhances financial inclusion in society but also significantly boosts revenue for service providers, complementing traditional voice and data services," the report said.

Ericsson believes 2G subscriptions will maintain a significant share of total subscriptions at 27% in 2029.

"This is mainly due to the region's largely rural population, for whom broadband coverage is limited and smartphone affordability is a challenge," the report added.

Strategic spectrum deployment propels 5G expansion

The bulk of mobile subscribers will remain on 4G networks for several years, and it will be some time before subscribers who have migrated to 5G reach a more considerable proportion.

However, Ericsson forecasts that 5G will be the fastest-growing subscription type between 2023 and 2029 at 60% annually.

There will be around 180 million 5G subscriptions in the region in 2029, accounting for 16% of all mobile subscriptions. That's compared to just 1.1% of all mobile subscriptions on 5G in 2023.

"Service providers will need to secure additional spectrum capacity or densify coverage in urban areas to preserve [5G] user experience, as these congested areas are increasingly reaching maximum capacity," the report said, adding that congestion is leading to service disruption.

Around 15 countries in Africa have now launched commercial 5G services – with Eastern and Southern Africa leading the way – and more launches can be expected as spectrum is released in low- and mid-bands.

"Many governments, including Kenya and Tanzania, have allowed service providers to reuse their existing spectrum assets, thereby enabling frequency refarming in line with technology neutrality principles. Most also gave service providers access to additional frequencies, especially in the mid-band, in sizable amounts to allow 5G to fully deliver on its promises of higher download speeds," Ericsson said.

"As these frequencies have a limited reach, releasing some low-band frequencies alongside them offers a strategic combination of 5G resources to simultaneously expand capacity and extend coverage," it added.

Only a few countries have released frequencies higher than 6GHz, which are needed for ultra-high performance 5G services.

"This includes around 80GHz in the E-Band for high-capacity microwave links to connect towers, which is especially effective in suburban settings where fiber may not yet be available," the firm said.

Fixed wireless access (FWA) has also emerged as a pivotal technology to advance Africa's increasing broadband demands. Markets like Angola, South Africa, Nigeria, Kenya, Zambia and Zimbabwe have already launched 5G FWA services.

Middle East and North Africa

The Middle East and North Africa (MENA) region is also expected to continue growing despite economic uncertainty in some countries.

MENA will see 2.4% overall subscription growth between 2023 and 2029, and smartphone subscriptions are expected to grow 5% annually over the next five years.

While 4G subscriptions will account for the bulk of the MENA base, at 54% by 2029, 5G subscriptions are projected to register the strongest growth in the period, at 41% compounded annually, to account for 41% of total subscriptions by 2029.

"Service providers are expected to increasingly push solutions such as mobile financial services – especially in parts of North Africa, where financial inclusion remains a priority – and FWA, which shows a discernible growth trend in the region," Ericsson said.

Related posts:

- Ericsson: Sub-Saharan Africa will have 1B mobile subs by 2028

- Sub-Saharan Africa's 5G subs will top 150M by 2028 – Ericsson

- 5G subs to hit 200M in MENA by 2027 – Ericsson

*Top image source: Freepik.

— Paula Gilbert, Editor, Connecting Africa