COVID-19 puts major dent in Africa's smartphone market

The COVID-19 pandemic has caused a big dent in Africa's smartphone shipments in the first quarter of 2020. In fact, it was one of the largest quarterly dips since 2015. This is according to new insights from International Data Corporation (IDC) which said the virus was the main reason for the decline.

IDC's Worldwide Mobile Phone Tracker shows that Africa's smartphone market saw shipments decline 17.8% quarter-on-quarter (QoQ) in Q1 2020, to 20.1 million units. The overall mobile phone market totaled 46.8 million units, down 20.5% QoQ, with feature phones accounting for 57.1% share of total units in Africa versus smartphones at 42.9%.

IDC explained that COVID-19 had a two-stage negative impact on Africa's smartphone shipments in early 2020.

"The pandemic initially restricted the supply of shipments into the region in February as manufacturers in China closed their doors. Then in March, the situation worsened as consumer demand was hit by local measures and lockdowns to combat the spread of the disease," the research and consulting firm said in a statement.

The pandemic negatively impacted all African countries but particularly the big markets of South Africa, Nigeria and Egypt, which suffered declines of 22.9%, 13.6% and 6.3%, respectively.

In March, IDC also warned that East Africa could expect a slowdown in its smartphone market during the coming quarters due to COVID-19.

However, the pandemic will likely boost spending on public cloud in the Middle East, Turkey and Africa (META) region as the crisis continues.

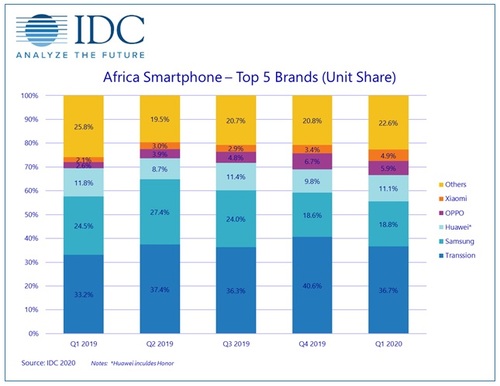

In terms of smartphone makers, Transsion brands (Tecno, Infinix and Itel) continued to lead the smartphone space in Africa in the first quarter of the year with a combined unit share of 36.7%. This was followed by Samsung with 18.8% market share and Huawei with 11.1%.

"COVID-19 severely disrupted the industry in Q1 2020, while consumer demand also showed signs of a mild decline," said Taher Abdel-Hameed, a senior research analyst at IDC.

"In such an environment, consumers are moving towards more affordable entry-level and mid-range devices. Xiaomi benefited from this trend and was able to drive growth over the quarter while most of the other popular brands reported declines," Abdel-Hameed added.

Looking ahead, IDC expects Africa's smartphone market to decline 9.1% year-on-year in unit terms for 2020 as a whole.

"A significant portion of mobile phone channels are closed in the region and economies have slowed down quite significantly during Q2 2020, which will lead to a weaker Q2 performance," said Ramazan Yavuz, a senior research manager at IDC.

"While we expect to see a recovery in the second half of the year through normalization efforts undertaken by governments, the heavy impact of the pandemic on the economies will be felt on the overall 2020 smartphone market," he concluded.

— Paula Gilbert, Editor, Connecting Africa