African Mobile Broadband Connections to Boom by 2024 – Ovum

There will be over a billion mobile broadband connections in Africa by 2024. This is one of a number of predictions made as part of Ovum's Africa Digital Outlook 2020 report entitled "Enabling the continent's digital economy" released ahead of the AfricaCom 2019 conference which kicks off on Tuesday.

The forecast of 1.08 billion mobile broadband connections by 2024 would represent 78.9% of the 1.37 billion mobile connections on the continent, according to Ovum.

The report was written by Matthew Reed, the practice leader for Ovum's Middle East and Africa regional research, who says that mobile broadband and financial services are key growth segments for the continent. For example, telco giant MTN recently reported that its financial services revenue grew by more than 30% over the past year.

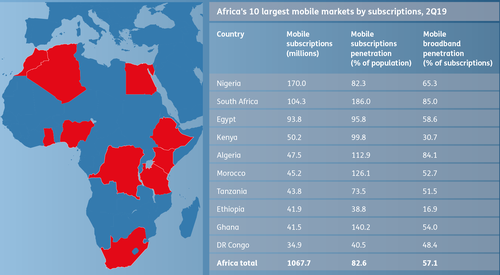

Reed says that the number of mobile subscriptions in general in Africa passed the 1 billion mark in 2017, and reached about 1.07 billion in June 2019, with a population penetration of 82.6%.

The report says there are good growth prospects in digital services as well as in data connectivity. But the industry and authorities across Africa need to develop their plans for the digital economy if the continent is to make the most of its potential.

Nigeria, the most populous country on the continent, also has Africa's biggest mobile market by subscriptions, with 170 million mobile subscriptions in Q219. The next-biggest markets are South Africa, with 104.3 million mobile subscriptions, and Egypt, with 93.8 million mobile subscriptions.

Mobile broadband devices and networks -- based on 3G and more advanced technologies -- accounted for 57.1% of connections on the continent in the second quarter of 2019.

"A sizeable majority (85.3%) of mobile broadband connections on the continent were accounted for by 3G W-CDMA in 2Q19. LTE accounted for just 14.2% of Africa's mobile broadband connections in 2Q19. 2G GSM still has a substantial market share, accounting for 42.9% of Africa's mobile connections in 2Q19," the report says.

Ovum believes that the number of W-CDMA connections in Africa will continue to increase through to 2024, in contrast with the global trend where W-CDMA connections are in decline. But the group forecasts that the number of mobile LTE connections in Africa will increase at a more rapid rate, rising from 97.5 million at the end of 2019 to 335.6 million at the end of 2024.

Fixed broadband household penetration in Africa was only about 8.5% at the end of the second quarter of 2019, lower than in any other world region except Central and Southern Asia.

The availability of affordable data devices is a key factor in African markets, where average incomes are typically low. MTN, Orange and Vodacom have recently introduced "smart feature phones" that use the KaiOS operating system and are priced at about $20 as a means of encouraging wider take-up of data services. (See Orange Unveils $20 KaiOS Smart Feature Phones, MTN, KaiOS, China Mobile, UNISOC unveil smart feature phone and Tanzania Joins Smart Feature Phone Revolution .)

Ovum says that instability, poor infrastructure and "digital divide" factors, however, continue to hold back digital development in Africa. Just one example of the barriers to digital development in Africa is that in 2018 the average cost of a 1GB mobile broadband plan on the continent was equivalent to 8% of average monthly income -- far above the affordability benchmark of less than 2% of income, according to the UN Broadband Commission.

Although the affordability of mobile broadband has improved in Africa -- considering that in 2015 a 1GB plan cost 12.5% of average income in Africa -- the results for the continent compare badly to equivalent markets in Asia and the Americas. In 2018, a 1GB plan cost 1.5% of average income in Asia, and 2.7% in the Americas.

Revenues on the rise

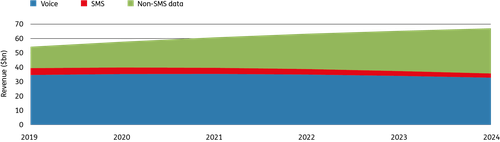

Due to the overall growth in the market and continued relevance of voice calling for many customers, some major African operators such as Airtel and MTN are still seeing growth in mobile voice revenue -- but data revenue is growing at a faster rate and its share of overall revenue is rising.

Ovum forecasts that mobile revenue in Africa will rise from $54.31 billion in 2019 to $67.12 billion in 2024, with non-SMS mobile data revenue on the continent more than doubling over that period from $14.91 billion in 2019 to $31.42 billion in 2024. Ovum expects mobile voice revenue in Africa to rise modestly through to 2021, but to decline thereafter to the end of the forecast period.

The report also highlights the growth prospects in Africa's digital market. Service providers are reporting strong growth in revenue from data access and digital services such as mobile money. Investment in Africa's tech startups is surging. The macroeconomic outlook is for economic recovery, and very strong population growth.

Rising connectivity in Africa is allowing telecom service providers to move into new service segments. It is also enabling growth in the broader technology sector, including startups.

"In 2018, African tech start-ups raised $1.16 billion in funding, a 108% year-on-year increase, according to a report by investment firm Partech Africa. Start-ups in Kenya, Nigeria, South Africa and Egypt received the most funding. By service sector, financial services accounted for 50% of the funding, followed by B2B services, and consumer services," Ovum says.

All eyes on Ethiopia

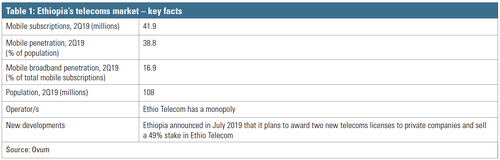

Ovum believes that the market to watch in 2020 will be Ethiopia.

Africa's many mobile operators are all keeping a keen eye on Ethiopia after the country's government in July revealed a significant policy change and announced plans to award two new telecom licenses to private companies and sell a 49% stake in state-owned operator Ethio Telecom.

"The planned liberalization of the Ethiopian market is rightly generating a lot of interest. With a population of 108 million, Ethiopia had mobile penetration of less than 39% in June 2019, substantially below the average of almost 83% for Africa as a whole," Reed says.

Currently, Ethio Telecom has a monopoly over the country's telecom market, and previously Ethiopia has rejected the idea of competition or privatization in the country's telecoms sector. The country's large population and low mobile penetration rate means it holds growth prospects that are likely to be of interest to most major operators on the continent.

"Mobile broadband penetration in Ethiopia is also below the average for Africa at less than 17% of total mobile subscriptions," the report adds.

— Paula Gilbert, Editor, Connecting Africa