The state of digital transformation in African banks

Around 76% of banks in Africa rank digital transformation as either their top priority or among the top three, and about 60% of African banks have now digitally transformed most of their operations.

That's according to the 2024 edition of The African Banking Digital Transformation Report published by pan-African publication African Banker and Backbase, creators of The Engagement Banking Platform.

The 2024 edition of the report drew on comprehensive survey data from more than 150 banks spanning 35 countries, providing analysis of current digital banking trends, key innovations and digital transformation progress.

The report was launched during Gitex Africa 2024, which took place in Marrakesh, Morocco, last week.

The report found that 36% of African banks consider digital transformation their top priority, down from 51% last year. Another 40% regard the transition as one of their three top priorities and the remaining 24% view it as important.

"The apparent fall in the importance of digitalisation for some banks may simply reflect the fact that they were yet to launch planned digital platforms last year but have now done so, making them a little more relaxed about the process," the authors of the report explained.

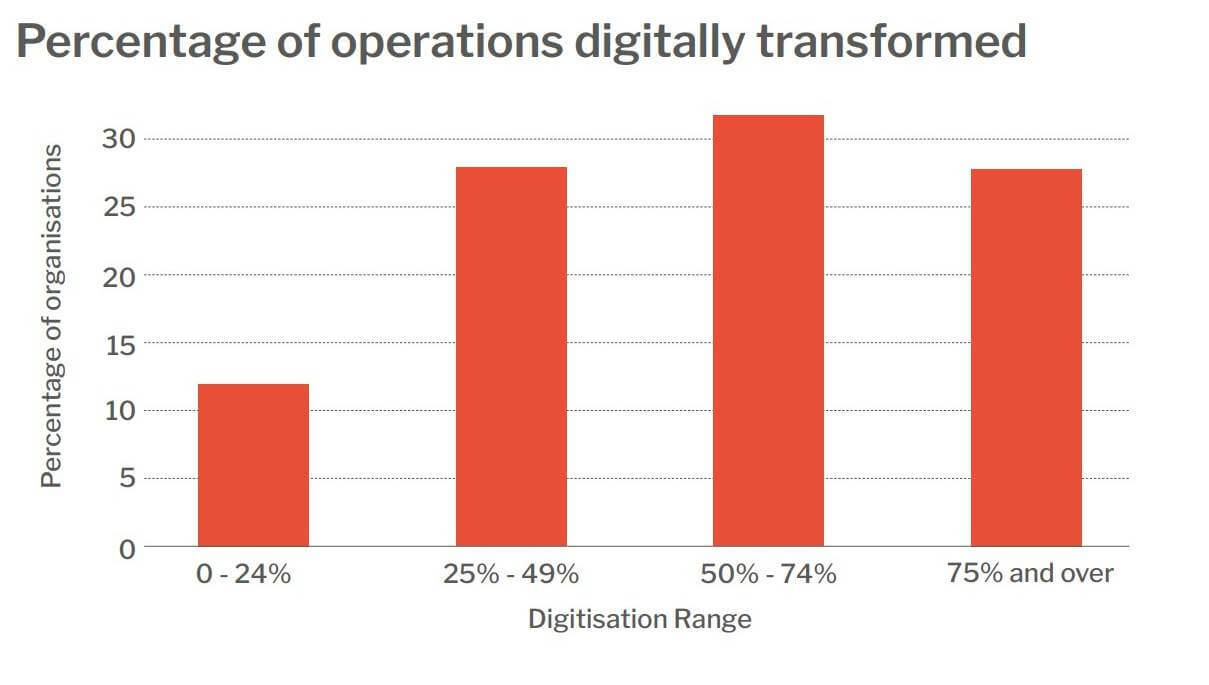

African Banker and Backbase also asked the survey participants how far the digital transformation had proceeded within their African organizations and 60% of banks said that most of their operations had been digitally transformed.

Just under half of these had transformed more than three-quarters of their operations digitally, while another 28% of organizations have digitally transformed between a quarter and a half of their operations. Just 12% of those surveyed had minimal digital transformation, with less than a quarter of their operations switched to digital processes to date.

The report found that banks are increasingly using data analytics to tailor offers to individual customers. Most banks either rely entirely on third-party developers to build their digital platforms or combine them with their in-house teams.

Potential customers grow

The report found that almost half of the continent is still unable to access any form of bank account, including approximately 60% of women – reflecting an opportunity for banks to grow their customer base through an inclusive digital offering.

In 2021 – the last year for which full figures are available – 55.07% of the African population had a bank or mobile money account, compared to 23.33% in 2011.

"The use of digital banking platforms by both banks and customers in Africa is transforming access to financial services on the continent. Allied with other technological advances, it is granting millions of people access to payment and even credit services for the first time," the report said.

"Banks that already offer digital savings and payment services are adding loan applications and other new functions in the face of growing competition and although the picture is mixed, it appears that the density of physical bank branches has already begun to fall," it added.

The authors said African banks are generally driven to invest in digital platforms by a desire to meet customer demand, the savings available and the potential of new technology to increase market share.

"It will be a lot cheaper to provide more services to more people via digital platforms than via physical bank networks, so it makes sense to invest in – and optimise – those platforms now. Customers who begin to use the digital services of one bank are more likely to opt for the same bank for business accounts and services if they are in a position to do so as an SME [small and medium sized enterprise] owner," the report's authors said.

At the same time, the population of Africa is growing quickly, from 819 million in 2000 to 1.49 billion in 2024, with forecasts to reach 2.49 billion people by 2050.

"The number of potential customers is rocketing. Moreover, of the just over 50% of Africans with a bank account, most still do not use digital banking, offering more room for growth, while the range of services available to digital banking customers is still growing," the report said.

Another factor impacting digital growth is the increasing number of devices such as smartphones and tablets, with mobile phones now accounting for 75% of web traffic in Africa.

"Benefits include speed, convenience, and enhanced user data, meaning that banks can much more readily tailor solutions for their clients," the report added.

Retail banking focus wanes

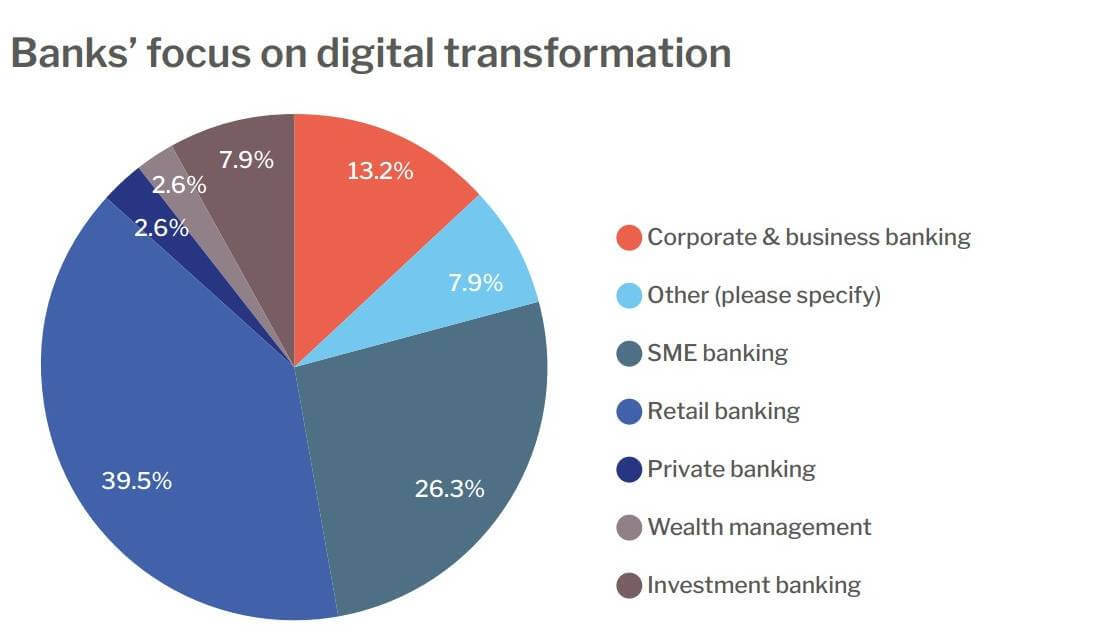

The survey found that 39.5% of banks named retail banking as their biggest priority in terms of digital transformation this year, down from 47% last year and 54% in 2022.

"It seems likely that many have already built mobile apps or internet banking platforms for their retail customers and are now putting more effort into replicating or building the same structures in other market segments, rather than due there being any loss of interest in the retail sector," the authors explained.

The proportion of banks prioritizing the SME sector was 26.3%, while 13.2% are focusing on corporate and business banking and 7.9% on investment banking, "as an increasing number of banks seek to ensure that the benefits of digital banking are felt across the full range of their operations."

Cloud leads digitization strategies

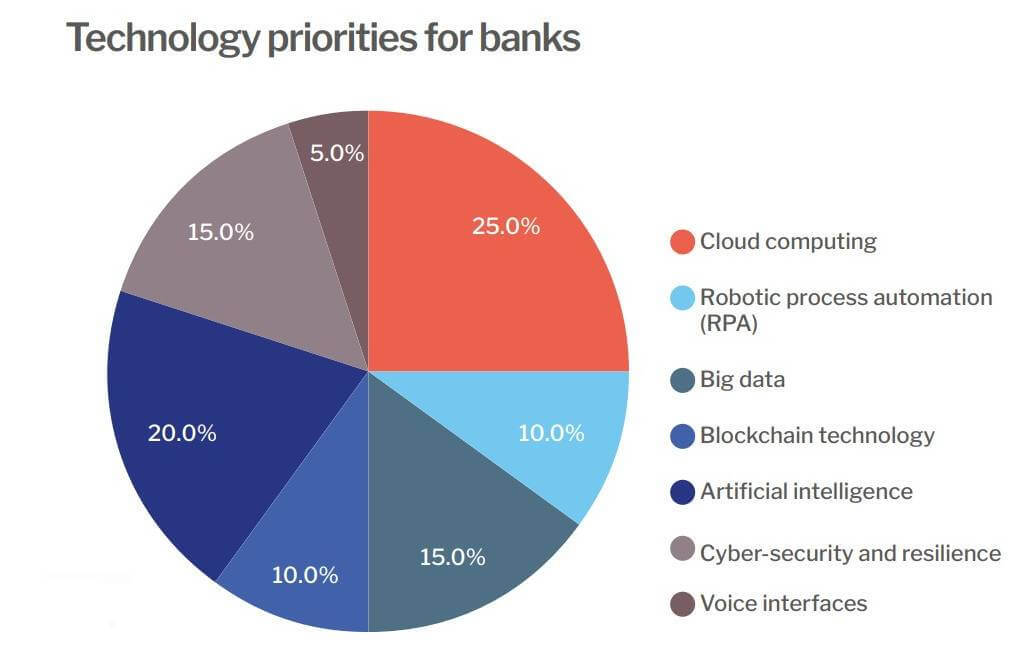

This year, cloud computing was the most cited technology being incorporated into digitization strategies, accounting for 25% of all replies. This overtakes artificial intelligence (AI) and cybersecurity and resilience as the primary driver in the 2023 survey.

In 2024, AI placed second with 20% of those surveyed saying they were incorporating it into their digitization strategies, followed by big data and cybersecurity and resilience, which were each cited by 15% of respondents.

"The result can be explained through the growing sophistication of AI solutions, which sees it spill over into other technology areas including cybersecurity," the authors said.

Interviewed for the report, Ecobank Group Chief Digital Officer Nvalaye Kourouma said he sees AI as a game-changer, both internally and externally, because AI-powered tools help overcome language barriers for engaging customers in different countries.

"We now have the capability to build local natural languages into our AI interactions so that language and writing are no longer barriers. Speech and image can be used to communicate more effectively. AI opens the door for a different level of engagement with our customers, so it's encouraging," Kourouma added.

KCB Bank Group Chief Technology Officer Dennis Volemi said the bank had already been using data analytics capabilities for credit scoring.

"That preceded the AI trend, but increasingly we see that as adoption advances, AI has the ability to improve our precision. Besides credit scoring, we are exploring use cases that allow us to utilise AI to review and structure contracts and customise them based on the customer's profile," said Volemi in the report.

Related posts:

- Visa shortlists fintech startups for accelerator program

- Tanzania bans unlicensed digital lenders

- Egypt to launch its first digital bank

*Top image source: wayhomestudio on Freepik.

— Paula Gilbert, Editor, Connecting Africa