West Africa has become mobile money powerhouse – GSMA

Over the past ten years, West Africa has emerged as a key mobile money player with the number of registered mobile money accounts doubling between 2013 and 2023, driven mostly by growth in Nigeria, Ghana and Senegal.

That's according to the GSMA's 2024 State of the Industry Report on Mobile Money which shows that sub-Saharan Africa remains a key driver of mobile money's success and is home to almost three-quarters of the world's accounts.

"For over two decades mobile money services have grown exponentially, driving financial inclusion for billions of people, opening up incredible opportunities for entrepreneurs and small businesses across the world," said GSMA Director General Mats Granryd in the latest report.

Today globally, 1.75 billion registered mobile money accounts are processing US$1.4 trillion a year, or about US$2.7 million a minute.

In 2023, registered mobile money accounts across the globe grew 12% year-over-year (YoY) although the YoY growth rate is slowing (from 15% in 2022 and 19% in 2021) – the GSMA believes this reflects the start of the industry's maturation.

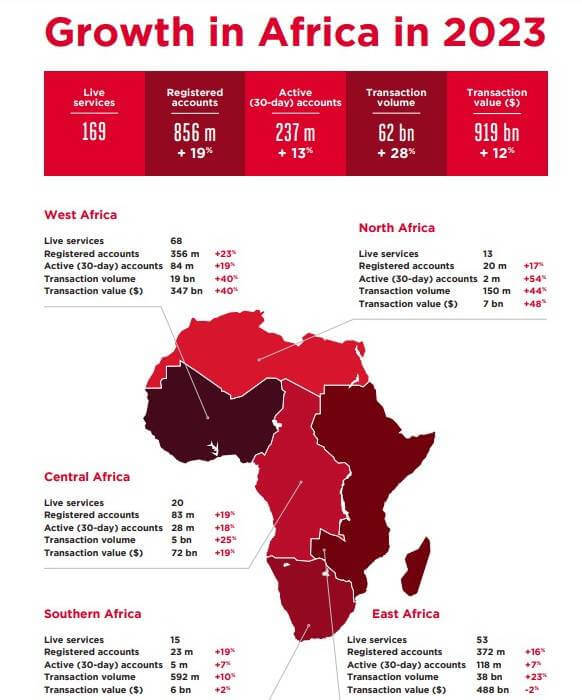

Growth has been pronounced in sub-Saharan Africa where the share of registered accounts has increased for two consecutive years to 47% in 2023, the highest since 2019.

Sub-Saharan Africa accounted for over 70% of the total growth in registered accounts in 2023, with South Asia contributing a fifth.

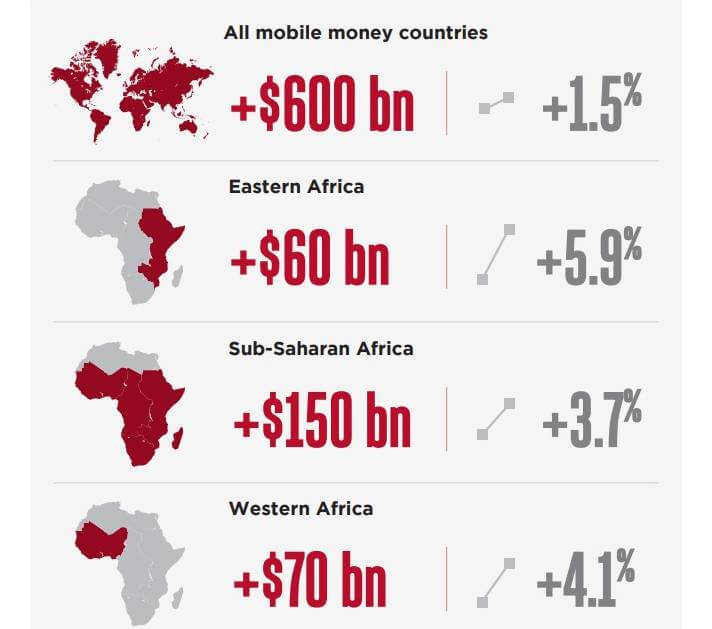

The GSMA said that in sub-Saharan Africa mobile money had helped increased gross domestic product (GDP) by more than $150 billion or 3.7% in the region between 2013 and 2022.

In East and West Africa – where mobile money adoption is highest – GDP increased even more, by 5.9% and 4.1%, respectively, by the end of 2022.

West Africa becomes mobile money powerhouse

West Africa – particularly Nigeria, Ghana and Senegal – has seen a 100% increase in registered accounts from 2013 to 2023, establishing the region as a leader in mobile money adoption.

In 2023, over a third of new registered and active 30-day accounts globally were from West Africa – more than any other region.

"West Africa's vibrant mobile money ecosystem has developed differently from East Africa. For instance, West Africa has seen more non-mobile-network-operator (MNO)-led mobile money services emerge to compete with MNO-led providers," the report's authors said.

"This growth, driven by enabling regulatory frameworks, has facilitated a shift to digital transactions, underpinned by a surge in international remittances and merchant payments," the GSMA researchers added.

For instance, the West African Economic and Monetary Union (WAEMU) experienced significant growth in the use of mobile money adding over 110 million new mobile money accounts between 2018 and 2022, in turn boosting financial inclusion from 56% to 71% for a population of over 137 million, with 60% residing in rural areas.

Mobile money is boosting socio-economic growth

"Mobile money has demonstrated its potential to transform economies and societies, driving financial inclusion and sustainable development worldwide. As the industry has started to mature, it is also clear that mobile money offers a sound commercial proposition," said Ashley Olson Onyango, head of financial inclusion and agritech at the GSMA.

The GSMA believes that mobile money has been a catalyst for achieving 15 out of 17 United Nations' Sustainable Development Goals (SDGs), up from 13 in 2019.

Credit is the most popular adjacent financial service offered by mobile money providers (MMPs), with a 73% increase in the number of credit products offered YoY in 2023.

This diversification of use cases is empowering the underserved, including women and rural populations, to save money through mobile money accounts.

"MMPs tracking disaggregated data found a 98% increase in the cumulative number of unique female customers saving via mobile money, between September 2022 and June 2023," the report found.

In addition, increased business adoption of mobile money saw average revenue per user grow from $2.2 in September 2022 to $3.2 in June 2023 – an increase of over 40%.

"To ensure mobile money remains safe, accessible and affordable, there is a clear need for governments and regulators to work with financial service providers to launch financial literacy programs that can empower underserved populations and improve their financial decision-making," Olson Onyango added.

Related posts:

- MWC Kigali 2023: Closing the mobile usage gap – GSMA

- Mobile money transactions hit $1.26T in 2022 – GSMA

- Africa accelerated mobile money growth in 2021

*Top image source: Image by freepik.

— Paula Gilbert, Editor, Connecting Africa