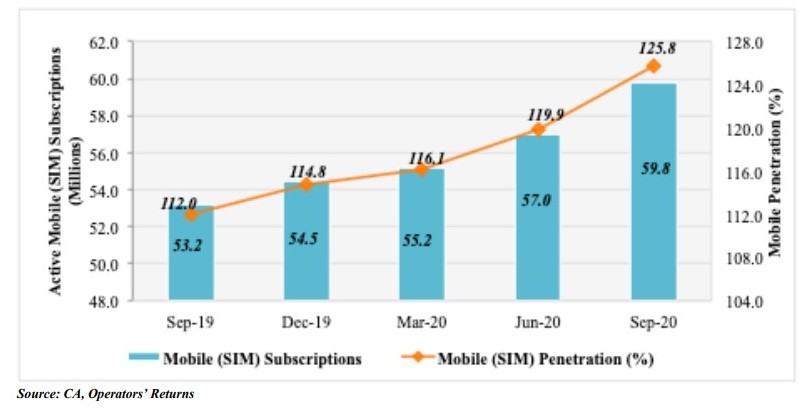

Kenya's mobile penetration increases to over 125%

Kenya's mobile market has continued to grow as demand for ICT services rose in 2020 due to the COVID-19 pandemic.

The country has a mobile SIM penetration rate of 125.8% and added 2.8 million SIM cards in the quarter ended September 2020.

This is according to the newest stats from the Communications Authority of Kenya (CA) – what it calls the Sector Statistics Report for the First Quarter of the 2020/21 Financial Year – which really provides an overview of the performance and trends in ICT sector for July 1 to September 30, 2020.

At the end of the quarter Kenya had 59.8 million active mobile subscriptions (SIM cards), up from 57 million subscriptions reported three months earlier. The CA puts Kenya's population at about 47.6 million, based on the 2019 Census Report.

Prepaid is still by far the most popular option in Kenya with 58.6 million prepaid users and just 1.2 million contract customers.

The growth in the quarter was also faster, adding 2.8 million more SIMs compared to 1.8 million in the quarter before.

"The substantial growth is attributed to [a] smartphones device financing service campaign run by Safaricom PLC dubbed 'Lipa Mdogo Mdogo' which began on 28th July 2020 and was aimed at acquisition of new customers," the report said.

Airtel's revised on-net pay-as-you-go rate for all Tubonge packs could also have enticed new customers, it added.

Market leader Safaricom lost a tiny bit of market share, with mobile subscriptions dropping by 0.5% in the quarter to a market share of 63.7%. Airtel and Telkom Kenya gained 0.4% and 0.3% to post 27.2% and 6.3% market shares, respectively. Small operator Equitel lost 0.2% to record a market share of 2.8%.

Data and voice growth

Overall voice traffic in Kenya grew by 19.6% during the quarter, to 18.2 billion minutes compared to 15.2 billion minutes recorded last quarter. The increase was attributed to specific promotions launched by operators in the quarter.

The CA said that in the quarter the Internet/data market also experienced positive growth with rising dependence on digital platforms for work, learning, healthcare, shopping and entertainment.

Total data/Internet subscriptions rose by 4.8% to 43.5 million. Mobile data subscriptions now account for 98.5% of all Internet subscriptions in Kenya.

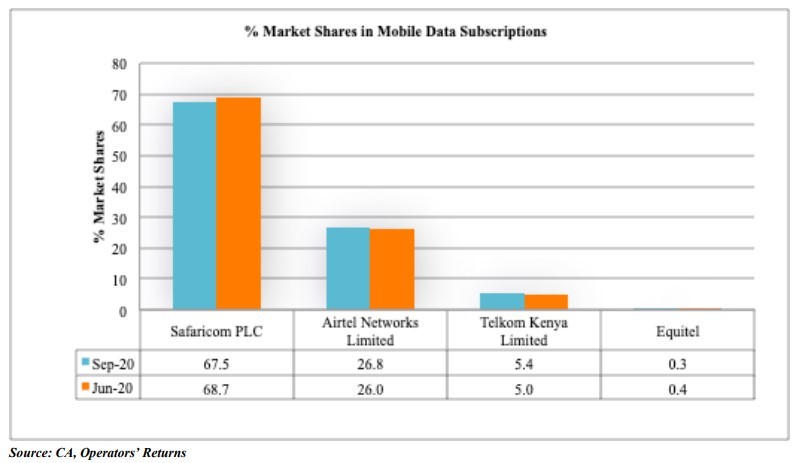

Unsurprisingly, Safaricom had the biggest market share when it comes to mobile data subscriptions, at 67.5%, despite a 1.2% drop quarter-on-quarter. Airtel gained 0.8% mobile data subs market share, to grow to 26.8%.

At the end of September 2020 there were about 31.8 million active mobile money subscriptions and 245,124 mobile money agents in the country.

"As was the case last quarter, the values transacted on mobile money platforms continued to increase with the adoption of cashless payments aimed at curbing the spread of COVID-19," the report said.

*Graphs source: Communications Authority of Kenya

— Paula Gilbert, Editor, Connecting Africa